Welcome to the better way to manage and earn more on your GIC portfolio.

As one of Canada’s leading no-fee registered deposit brokers, we’ve been able to consistently provide higher deposit rates for our clients than any local bank by having access to exceptional wholesale Guaranteed Investment Certificate issuers.

With over 40 years of experience, we’ve become Uniquely Qualified® to help conservative investors like you manage their fixed term GIC portfolios using capital preservation, guaranteed growth and bonus GIC rates as benchmarks.

Fiscal Agents Savings & Investment advisors have taken the guesswork out of money management with insightful advice and a multitude of products and services. We offer GICs with:

- Flexibility – if and when market conditions change, the widest choice of investments and issuers.

- Convenience – with door-to-door service, our no-fee deposit placement service is second to none.

- Predictability – the knowledge that the principal and interest mature and pay regularly.

- Security in knowing that we offer GICs insured by the CDIC, along with provincial programs, like FSRA in Ontario, or Assuris member firms.

GICs have always been a secure part of any portfolio and a popular choice among those looking for a low-risk interest-earning investment. However, long gone are the days when GICs offered investors little more than a safe place to keep their money.

It’s all in the choices you have, so why settle for what your local bank branch is offering?

The GICs of today have become more flexible while still providing a reasonable return with very low risk. Financial institutions have introduced a variety of different maturity and payment schedules to consider.

Putting the GIC puzzle together

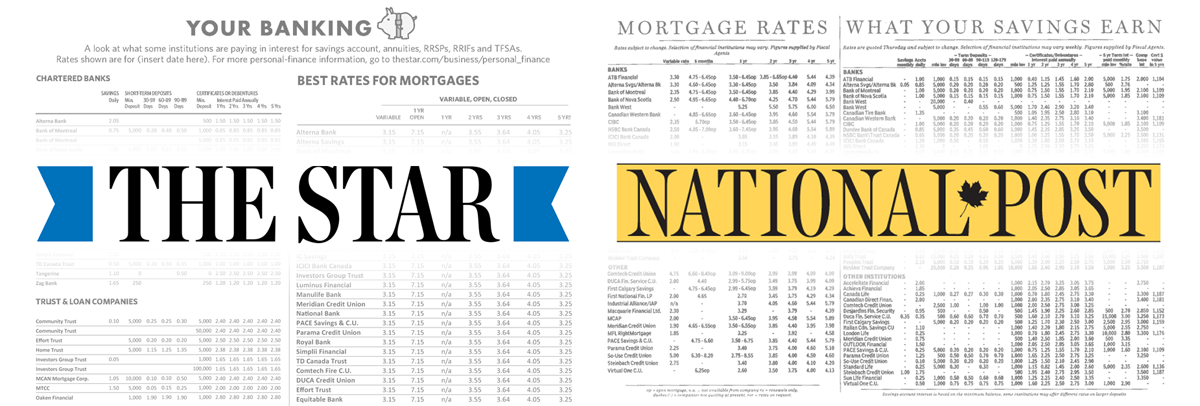

We have developed a national rate-quotation service in conjunction with both national and regional financial institutions, which for decades has run under a number of media partner websites including thestar.com and others, as well as appearing in print newspapers such as the Toronto Star and the Financial Post.

The Star and National/Financial Post interest rates surveys

When it comes to investing and planning for the future, the sheer number of options and opportunities can become overwhelming.

We use our market surveys and our buying power to gain higher deposit rates and pass these top rates on to you each day. We’ll save you time and help you earn more on your money by doing the research, shopping around and providing a better rate for you — all at no fee. Our services are paid for by the institution at no cost to you.

Record-keeping is the key to better Money Management

What’s the best way to keep track of and manage a fixed-term investment portfolio?

For your GIC, RRSP, RRIF and TFSA fixed-term deposits, the details are organized and updated in an easy-to-read format. The MoneyGuide Statement and Interest Income Planner provides a overall account performance summary, along with graphical illustrations of your entire holdings. You also have options to customize certain key elements of the reports.

Our MoneyGuide Statement and Income Planner are considered best-in-class, providing a complete set of financial records designed to make your financial picture as clear to you as it is to your accountant — all in one report.

Features included for each product category:

- Your current portfolio value and high/low income years

- Year-end T5 summaries

- Interest payments and income calendar

- Year-over-year maturity, plus all transactional reports

Incorporate multiple account types:

- Single or joint named accounts

- Open or Registered Retirement and/or Interest Income Fund accounts

- Tax-free accounts

Read more about how the MoneyGuide Deposit Tracker can help you manage your fixed term portfolio.

Why conservative investors choose GICs

- Guaranteed by the issuer and insured up to $100,000 by the CDIC (some provincial deposit protection plans are higher) per depositor per institution

- Fixed rate of return and flexible options all ensuring predictability

- They’re not vulnerable to the downside risks associated with investments such as stocks, bonds and mutual funds

- Investors are assured that the fixed-income portion of their portfolios are the safest part — built to maintain its value even if other financial markets decline. The first priority is full return of capital while providing an income.

Fiscal Agents – a no-fee deposit broker

We’ve been monitoring the banking and trust industries’ products and services since 1977. Our interest rate surveys are published in both national and regional media outlets. Thus we are Uniquely Qualified® to help guide you through Canada’s financial supermarket. We talk to more than 40 financial institutions each day, reviewing and monitoring many thousands of savings and investment products for you to choose from.